- PrivateEquityGuy

- Posts

- Making $10-100m+ per year for their bosses

Making $10-100m+ per year for their bosses

while bosses buy jets, here's how they ensure A-players never leave...

Over the past few years, I've gotten to know many investment professionals who have made their bosses obnoxiously wealthy.

We're talking about 10s or even 100s of millions in earnings per year. Even private-jet-ownership-type money.

The wildest thing is that these investment professionals don't even own equity in the firm...

On the other hand...

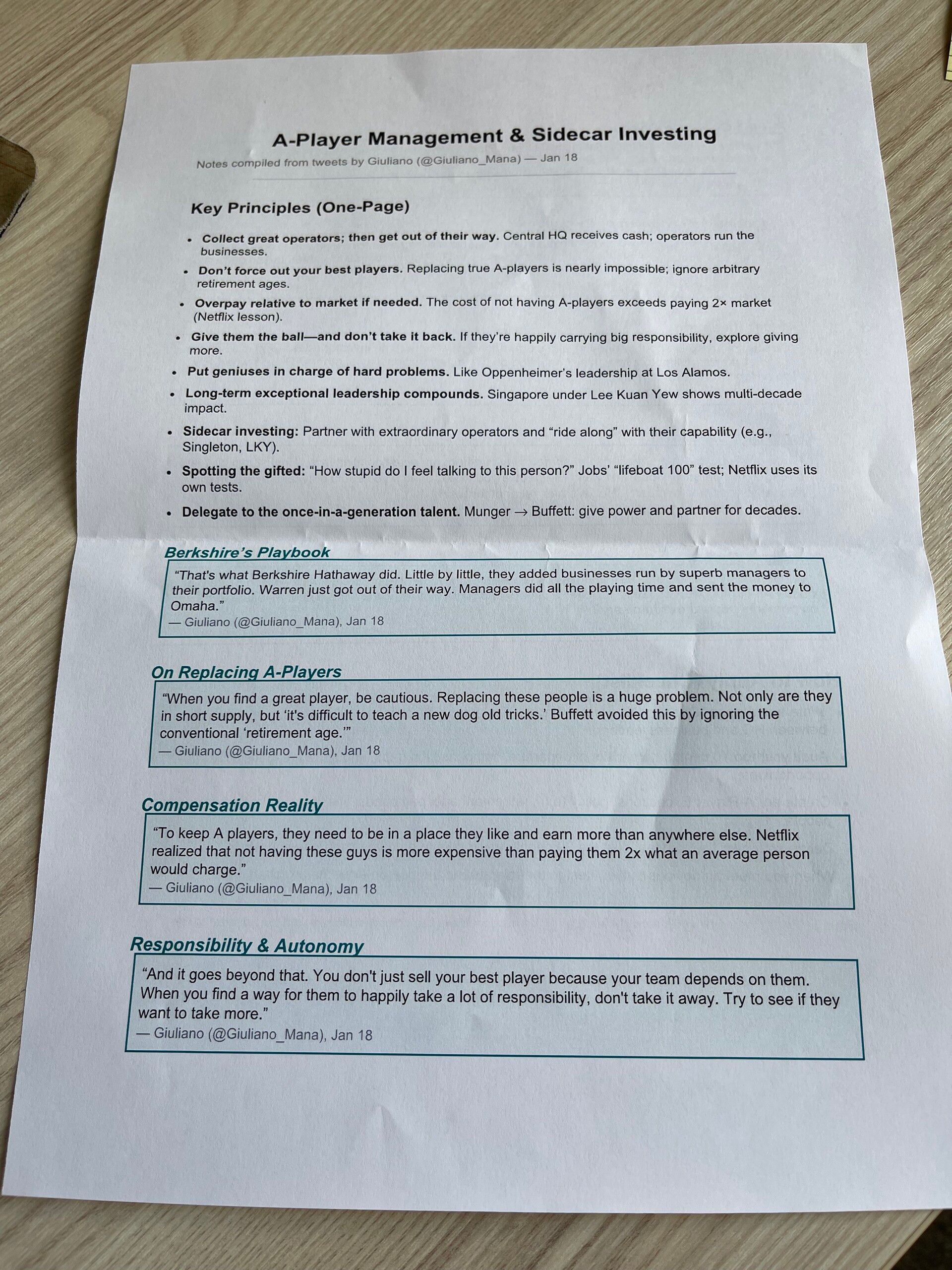

I believe these are some of the key principles their bosses follow to ensure A-players never leave and they keep making $10-100m+ per year:

Page 1

Page 2

(s/o to Giuliano Mana thank you for the research you're done on "when you find a genius, give them all power". I learned a lot from your tweets. Then created this summary for myself)

- - - -

You can't fake curiosity, passion and burning desire to master your craft.

Be it investing deal-by-deal...

Building a portfolio of cash flow businesses.

Funding early stage VC firms, or running a B2B enterprise software company.

You're competing against people who live and breathe the craft, and if you're not… VERY difficult.

You might get lucky a few times, but in the long game, folks with passion will run circles around you.

-

So if you’re running your business, or holding company or investment firm and you are NOT really passionate about creating content but would still be rewarded with trust from your clients, deal flow from folks buying companies, or simply having talent coming to you – consider Spacebar Studios doing all this work for you.

They’re a done-for-you newsletter service for companies: strategy, writing, design, and distribution— all handled by them.

Picture a crisp monthly update that sellers forward, LPs actually read, customers remember, and candidates want to join. No more “we should write more” guilt.

Spacebar turns your ideas into consistent, compounding attention.

Book an intro call by clicking here (or on the logo below), mention PrivateEquityGuy, and get your first editorial roadmap on the house (for free).

- - - -

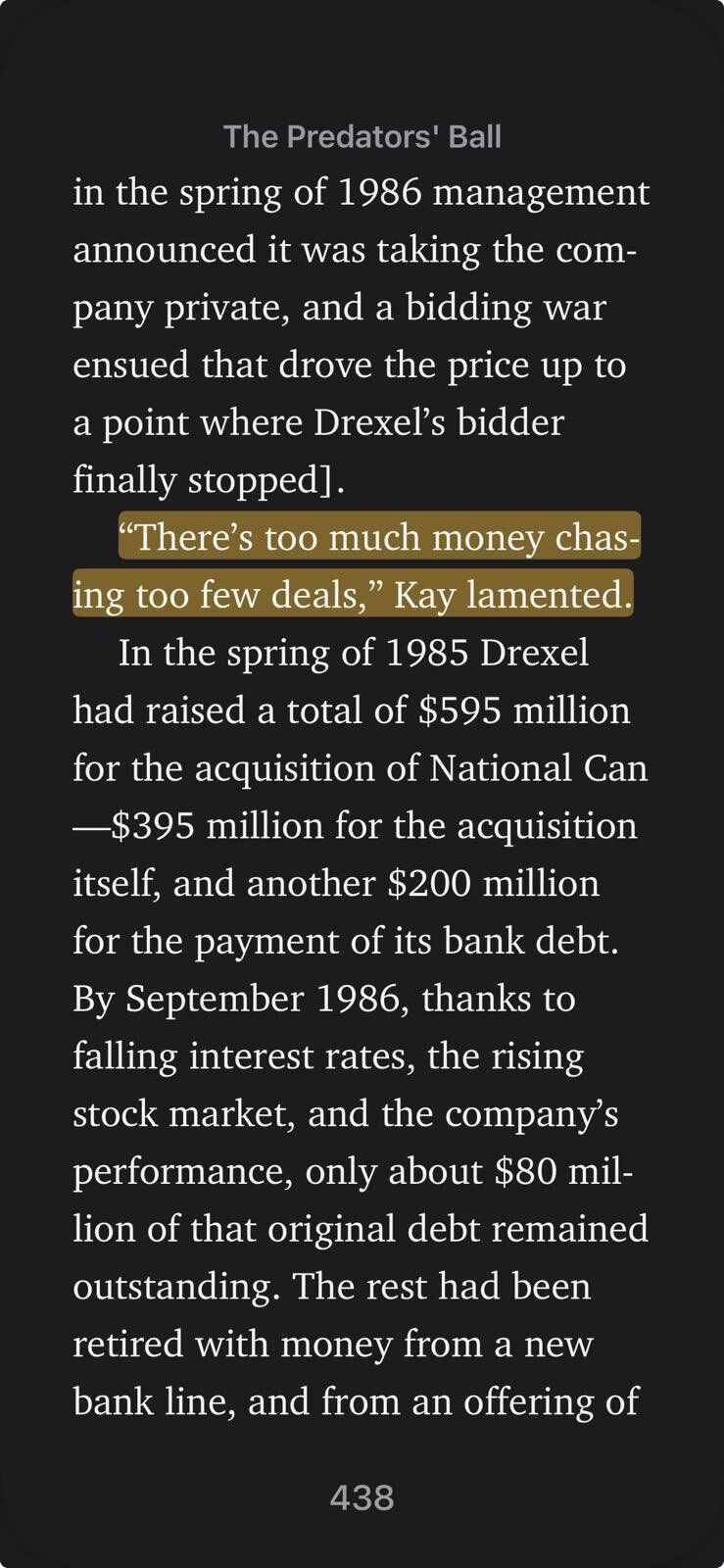

“There is more capital than great deals right now.”

A current very common situation for gentlemen acquiring $2–20mm EBITDA businesses with a deal-by-deal model.

Not a week goes by without me hearing it.

And then there’s this famous quote:

“There’s too much money chasing too few deals.”

So maybe after all it’s cyclical, and we go in waves where the cost of capital is more attractive than others, or perhaps this time is truly different as capital markets and access to capital in what is the lower middle market has evolved and matured?

- - - -

This week I had a very profound 20 min conversation with an independent searcher:

He's ca 7 months into a focused search:

So far ca 75 owner calls,

30 in-person meetings,

8 IOIs,

5 LOIs,

2 active LOIs

The lesson from this is that, yes, volume matters, but focus + domain expertise are way more important than spray-and-pray.

Quality convos > mass outreach

So… the biggest competitor for independent searchers isn’t private equity or strategics...

It’s the owner choosing not to sell.

- - - -

One under-discussed tactic in deals:

While most buyers optimize for max leverage, some deal makers sometimes do the opposite.

They "overequitize" by putting $500k–$1m extra equity (just cash) on the balance sheet.

May looks inefficient… until a black swan shows up.

- - - -

Excellent answer from a very successful independent sponsor:

What to hunt?

“Growing industries

businesses with recurring/reoccurring revenue

≥50% gross margins

and REAL growth

NB!!You don’t get bonus points for degree of difficulty. Pick compounding machines, not turnarounds”

-

That said, if you’re an investor looking for opportunities with clear theses, incentives aligned, and real operators at the helm.

Go look at deals on CapitalPad (sponsor for this newsletter) - it is the SMB investment platform that connects accredited investors with acquisition entrepreneurs, so more great small businesses end up in the hands of capable operators.

(Nothing here is investment advice—do your own diligence)

Hit the link, create a profile, and help power the next generation of SMB ownership.

- - - -

Lack of competence in finding and attracting a high-quality successor seems to be a pretty large reason folks are willing to sell their $5-20mm revenue business.

- - - -

How risky is it really to leave a top-paying PE firm to become an independent sponsor and buy a $2–10M EBITDA business yourself?

(Think of people working at Warburg Pincus, Vista Equity, KKR, Bain, Carlyle, TPG, Hellman & Friedman, Apollo.)

I read that Bezos has said most decisions are two-way doors:

If you step through and realize it’s a mistake, you can walk back.

Consider people at large PE firms.

“Compensation is exceptionally attractive and tends to improve year after year..”

“Few industries pay as well. If you’re financially motivated, it gets harder to leave over time and vesting carry makes it harder still.”

Yet some still choose to leave and apply what they’ve learned by buying and operating companies themselves:

B2b SaaS

consumer

HVAC

real estate

pool cleaning

metal manufacturing, etc.

Yes, cash comp will likely be much lower for a few years. But if early deals go well (say 2-5x MOIC), they can either raise a fund or keep going deal-by-deal.

Viewed through Bezos' two-way door lens, leaving a high paying PE job isn’t as risky as it looks…

If things aren’t going well and you realize it’s a mistake, you can walk back.

To really understand the reality of leaving your carry, NYC apartment on the 15th floor and Principal salary at a PE firm to buy two companies..

I recorded an hour-long episode with a gentleman who did just that!

He's happier (and busier) than ever.

Which leads me to this week’s podcast.

Here are a few takeaways from this conversation:

1. PE trains process, not judgment, and slow feedback loops turn many into paper pushers.

2. Start with WHY: why the industry exists, why this company wins, then ask price.

3. Build conviction with 2 to 4 hard thesis pillars and try to kill them before you buy.

4. Depth beats templates, so create a plan tailored to the business instead of a cookie cutter first 100 days.

5. The first deal is a street fight for capital, so pick aligned money and beware family office mirages.

6. Protect focus and pause new teasers to operate first so discipline can compound.

7. The decision stops with you, so own the call and value autonomy even if hours go up.

8. Take the risk early because AI will eat execution and the edge is judgment and finding great deals.

I hope you enjoy and learn a lot!

(I asked the editor to make two thumbnails; one is a little spicier, based on what Donza said, of course :))

Here are the links to Spotify, Apple Podcasts and YouTube.

That’s all for today.

Thanks a lot for reading and I’ll talk to you again next week.

Take care,

PrivateEquityGuy / Mikk Markus