- PrivateEquityGuy

- Posts

- 10< acquisitions, 24% CAGR while reading 1-2 hrs a day is key

10< acquisitions, 24% CAGR while reading 1-2 hrs a day is key

could this perhaps lead to your firm quietly compouning at 40% annually for 15+ years (like the story below)

One of the most important reasons I decided to pursue my bachelor’s degree in Geneva, Switzerland (besides education), was to see WHO I would be competing against in the future when I decided to play the game of raising capital from LPs to acquire traditional niche companies.

Days spent in classrooms, nights in the dorm discussing ideas, and weekends hiking...

Two insights:

1. As I got to know people, I quickly realized that it was doable. I could compete with them. No problem. It’s extremely competitive, but 100% doable.

And an even bigger realization…

2. It’s never about lack of skills, knowledge, or resources. It all comes down to work ethic and the courage to actually do it — to partner with the right people, to ask big questions, to make bold decisions.

- - - -

Relationships run the world. Period.

So let’s be real for a second… running a business is lonely.

Whether you're closing your first deal or managing your tenth acquisition, most days you’re either flying blind or talking to people who don’t get it.

That’s why I love Scalepath.

They’ve built a network of over 2,000 business owners across the U.S. and Europe—and when you book a free call, CEO Rand Larsen will personally introduce you to up to 3 vetted operators in your area.

A friend of the pod, Nathan Niehuus, put it perfectly:

"Men will literally join Rand’s group instead of going to therapy.😂”

But seriously…

Scalepath is part operator group, part growth engine, and part emotional support line.

To get to know 3 vetter operators in your area: Book your free intro call now at JoinScalepath.com

Because in this world, relationships are your edge—and sometimes your therapy, too.

- - - -

I had this screenshot on my phone.

I've already forgotten which well-known and great capital allocator said this, but it's worth sharing...

And more importantly, acting on it.

- - - -

We believe your next phase of B2B growth starts in your inbox.

If you run a company doing $1M–$50 M in revenue and want a growth channel that compounds every time you hit “send,” meet Spacebar Studios.

What Spacebar Studios does

They build, launch, and scale B2B newsletters. Fast.

0 → 50k+ subscribers in compliance, marketing, HR, hospitality, and other niches

Own content strategy, design, audience development, and reporting end-to-end

Proven playbooks that turn newsletters into pipeline, market authority, and owned audiences you control

Proof in the pipeline

Took a compliance newsletter from zero to 115k subscribers 14 months

Grew a hospitality list to 35k+ engaged operators with 5%+ avg CTRs

Helped multiple SaaS and services brands turn newsletter-first audiences into 7-figure pipelines and ARR

PrivateEquityGuy Offer

They’ll set up a brand-new newsletter for free for the first six companies that book a strategy call this month.

No fees. No strings. Just our team building your newsletter engine from day one.

Book your call here and reserve your slot while they’re still open.

- - - -

Last week I posted:

This post got many SUPER experienced people sending me DMs.

One guy is in his early 30s who has closed 10< deals and diligenced 50< companies

He is a CFO of a large European firm created through a rollup strategy. Leading a team of 60 ppl, invested EUR 1bn< and doubled value in 2.5 yrs.

(People and conversations are the reasons I build in public & sharing my journey)

All this has brought deal flow, connections with folks with deep operating experience, so if you too are looking to invest capital. Feel free to reach out or fill the form:

- - - -

Over the past two weeks I've seen many great acquisition targets.

All three follow the '3 owner trap' checklist:

Owner is also the top salesperson

Owner does the books

Owner runs operations

Buyers' main job post-close?

Systematize, professionalize, and free the business from the founder’s brain.

- - - -

Not a single week goes by when I talk to traditional biz owners…

A big realization is that too many businesses under <$15M aren’t sellable…

owner is the business

sloppy financials

one customer = 35-40% of revenue

declining sales/profit

no systems

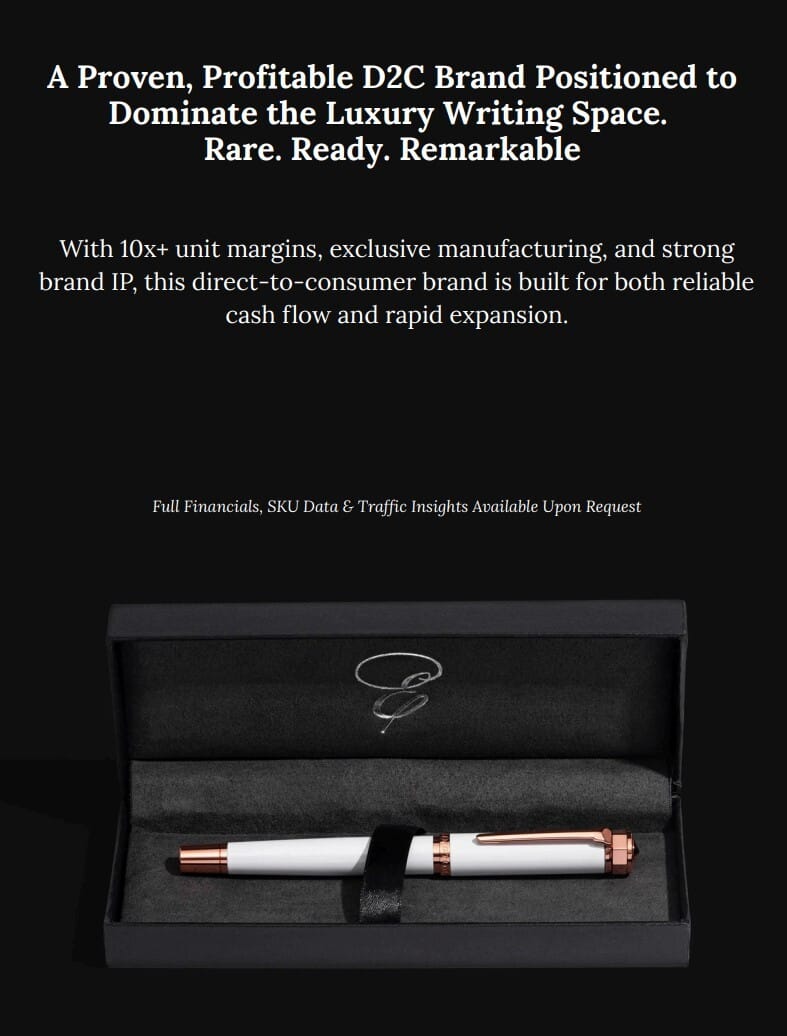

But not the one here:

Let me know if you are interested in investing in or acquiring this company by replying to this email.

- - - -

I just got back from Norway and these people aren't doing so bad.

21 year old investment firm and 59% gross realised returns. Recent fundraising brought in an additional $1.9B in capital.

Here is his speech in full (I have to say, it's some REALLY GOOD STUFF!!)

- - - -

Some lessons from interviewing 75+ acquirers:

-It’s not about buying companies

- It’s about building companies… through acquisition

- They pick targets that fit their long game.

- They don’t just buy EBITDA. They buy people who can run for 10+ years

- The acquisition is the starting line, then the real work starts

- You don’t need 20 companies

- You need 3 great ones you can compound for 30 years

- - - -

How has been the week in the small holding company world?

A great part when looking at $1-5M EBITDA traditional businesses is that you get to sit down for half an hour, an hour, hopefully many, many times with the owner that's "I've studied this space, I've lived and breathed this business and I'm going to tell you everything about it right now."

I feel that's super cool. To spend two or three hours a day learning from someone experienced in a very specific area of business industry.

Traditional company

Just had a call with the owner of the heavy equipment rental company. He will introduce me to the CEO in the 1st or 2nd week of August. I keep you posted.

Consumer loan company

Modena Capital continues to scale with discipline and clarity—prioritizing performance over noise.

June was no exception:

— 23% growth in our loan portfolio

— €450K+ deployed in active SME lending

— 76.19% investor retention – a signal of growing trust

- - - -

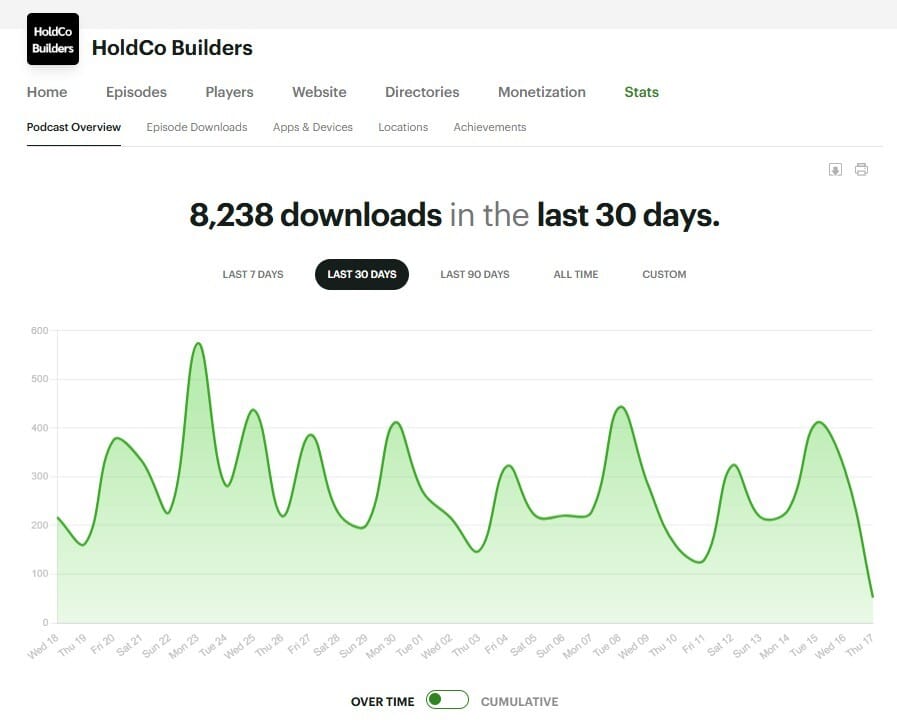

This week’s podcast

Tbh I never thought too many folks would listen to my hour-long business acquisition podcast.

I started it because it was to learn and hear stories from people who are on the same journey

In the last seven days Spotify and Apple have received over 8,200 downloads combined.

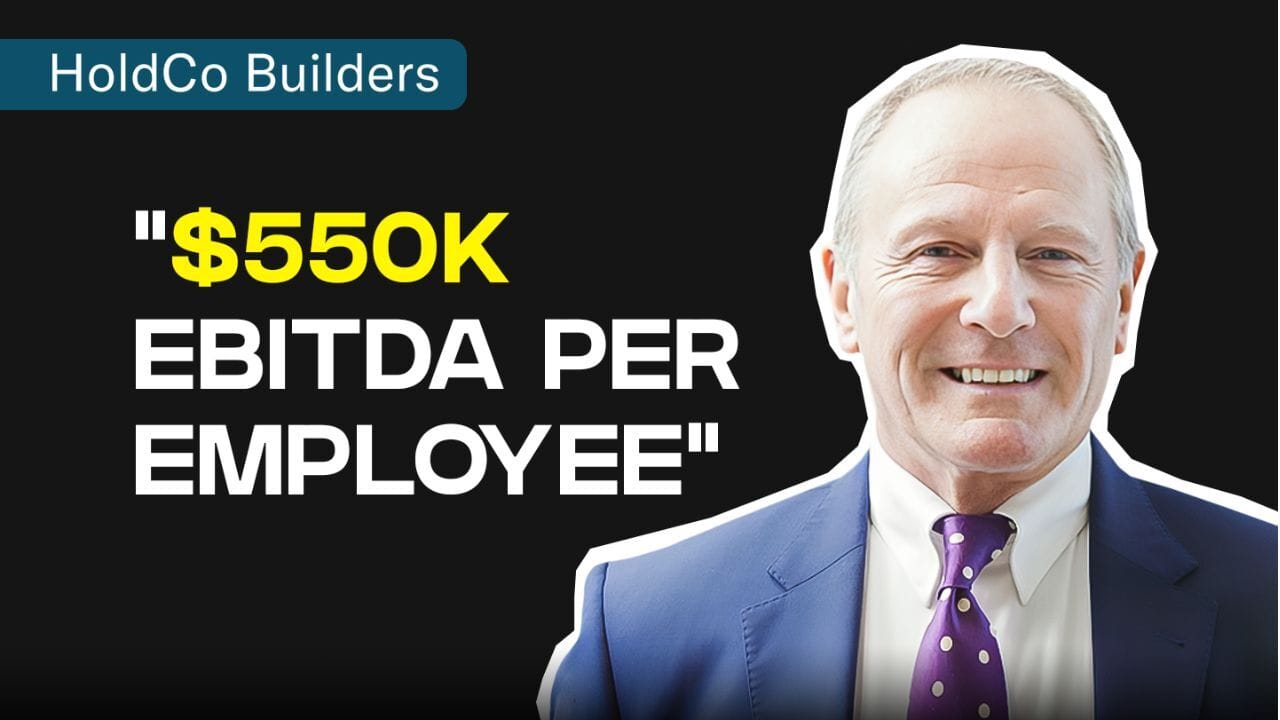

One UK company has quietly compounded at 40% annually for 15+ years - through tiny acquisitions, ruthless efficiency, and vertical integration.

It's called True Potential, and it might be the most under-the-radar roll-up success story in Europe.

5 takeaways from the episode:

1. They didn’t buy companies. They bought books of business.

2. Vertical integration + operational efficiency= 70-80% EBITDA margins.

3. 90% of assets in in-house funds. They're not wealth management. They're a fund manufacturing with a distribution arm.

4. M&A ROI in two weeks and that before leverage. They were printing returns before debt even kicked in.

5. Half a million in EBITDA per employee.

Here are the links to Spotify, Apple Podcasts and YouTube.

That’s all for today.

I really appreciate you taking the time to read and look forward to talking to you again next week.

Take care,

PrivateEquityGuy / Mikk Markus